Just like you wouldn't take this truck on the job to pour concrete at the Pro Football Hall of Fame, likewise there are other investment options beyond a simple IRA for your expanding company. Welcome back to my channel! So, your company has expanded and you are debating on whether to switch from a simple IRA to a 401k. Well, what are the pros and what are the cons? A simple IRA is a great way to get up and running for a business that just wants to start giving some sort of benefit to their employees. However, there are reasons that you would want to transition to a 401k. The first reason someone might want to transition is that they have younger employees who are wanting to save towards retirement. In a simple IRA, you only have pre-tax dollars options. So, if I'm in my 20s, 30s, or 40s, I might be really interested in paying my taxes now and not later in retirement. A simple IRA just doesn't have that option. In a 401k, you can have that option. The second reason a person would want to transition from a simple IRA to a 401k is that you're just able to contribute more into it. Let's look at this from the high earners' perspective. If I am really looking for a tax deduction, saving towards retirement is a great option. In a simple IRA, as of 2018, you are able to contribute $12,500 towards retirement. If you're 50 and older, you're able to add an extra $3,000 on top of that. A 401k has increased deferral limits. So, in 2018, you are able to contribute up to $18,500 into your 401k. If you're 50 or older, you have that catch-up contribution that you're allowed to give of up to $6,000....

Award-winning PDF software

Simple ira change Form: What You Should Know

Page 2 of 2. First name (or first initial and last initial) for individual beneficiary. I am an additional beneficiary of a SIMPLE IRA plan in the name of a Trustee(s) with the Bankruptcy Court. I (the Trustee) have no authority to approve, sign, issue, or execute this form. This Form is not an offer, solicitation, contract, offer in compromise or other contract of sale of or other transaction of any kind by the Bankruptcy Court to or on behalf of any person nor is it intended to create an agency, partnership, joint venture, department, or subdivision of the foregoing. Page 3 of 2. To be valid, it must be signed by the interested party. Page 4 of 2. The signing of this Form represents the free and voluntary agreement of the signer(s) and does not constitute an agency, partnership, joint venture, department, or subdivision of the foregoing. No one should make an appointment until he is certain that a representative (or his attorney) is on hand to accept payment (even if only for the benefit of the individual) and to represent the interests of the individual in case any disputes arise. For a complete listing of attorneys in your area, visit the following web page at. All individuals who are admitted to a person's bankruptcy court by filing an agreement with the court before the date the agreement is accepted by the court must be present to sign the agreement when it is signed by the judge. If all parties do not attend, a representative of the bankruptcy court may sign or record the agreement and certify its execution. Page 5 of 2. The parties agree to remain bound by this Form and agreement, or they may choose to waive any right they may have or to change them. Page 6 of 4. If you choose to waive your rights to pay and may be required to pay a greater percentage of your pay to the bankruptcy trustee, this agreement applies to the waived percentage of your pay only and does not affect any other portion of your pay for which an agreement has already been made with the bankruptcy trustee (or the trustee may elect to waive the waiver for any or all amounts owed in excess of the waived percentage of your pay).

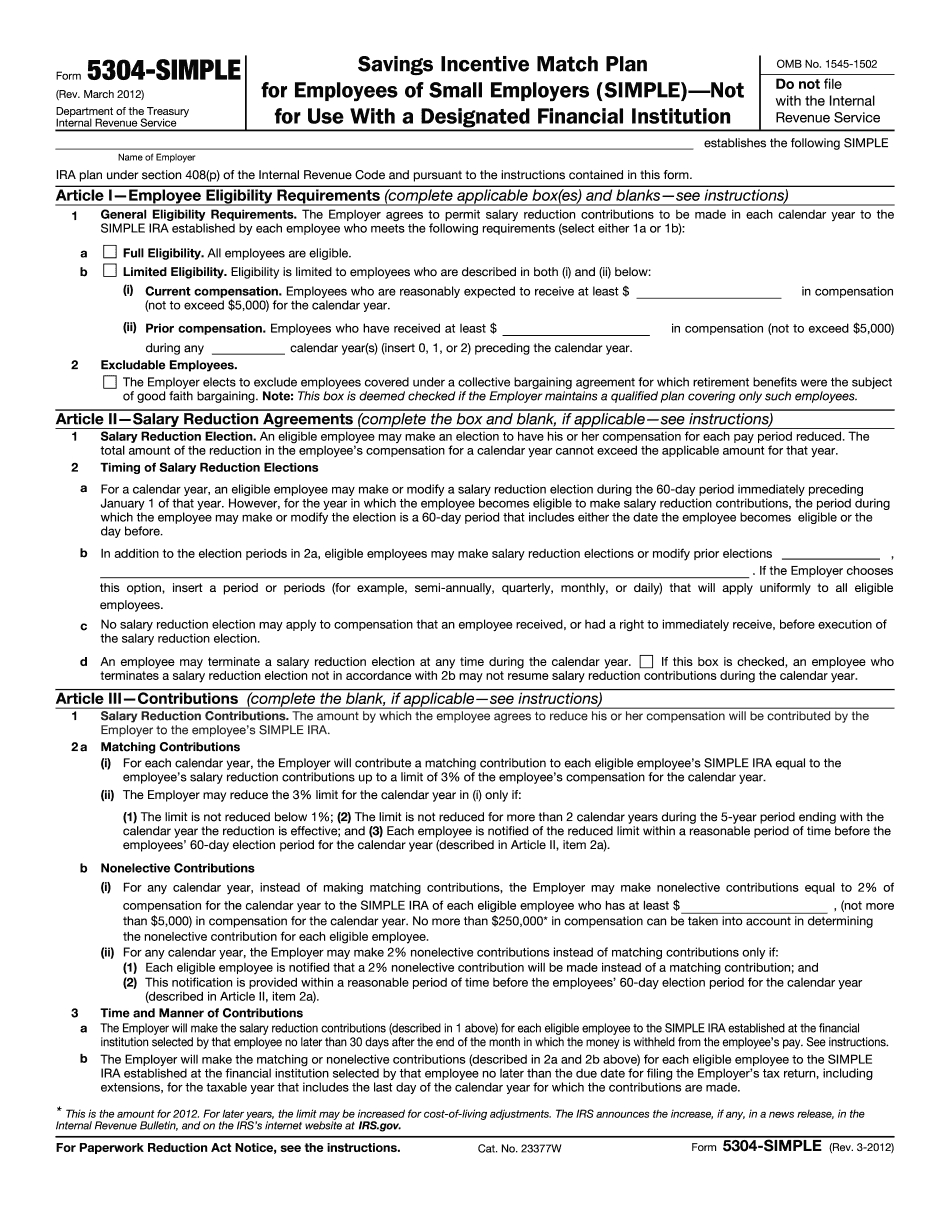

online solutions help you to manage your record administration along with raise the efficiency of the workflows. Stick to the fast guide to do Form 5304-SIMPLE, steer clear of blunders along with furnish it in a timely manner:

How to complete any Form 5304-SIMPLE online: - On the site with all the document, click on Begin immediately along with complete for the editor.

- Use your indications to submit established track record areas.

- Add your own info and speak to data.

- Make sure that you enter correct details and numbers throughout suitable areas.

- Very carefully confirm the content of the form as well as grammar along with punctuational.

- Navigate to Support area when you have questions or perhaps handle our assistance team.

- Place an electronic digital unique in your Form 5304-SIMPLE by using Sign Device.

- After the form is fully gone, media Completed.

- Deliver the particular prepared document by way of electronic mail or facsimile, art print it out or perhaps reduce the gadget.

PDF editor permits you to help make changes to your Form 5304-SIMPLE from the internet connected gadget, personalize it based on your requirements, indicator this in electronic format and also disperse differently.

Video instructions and help with filling out and completing Simple ira change form