Award-winning PDF software

Form 5304-SIMPLE Carmel Indiana: What You Should Know

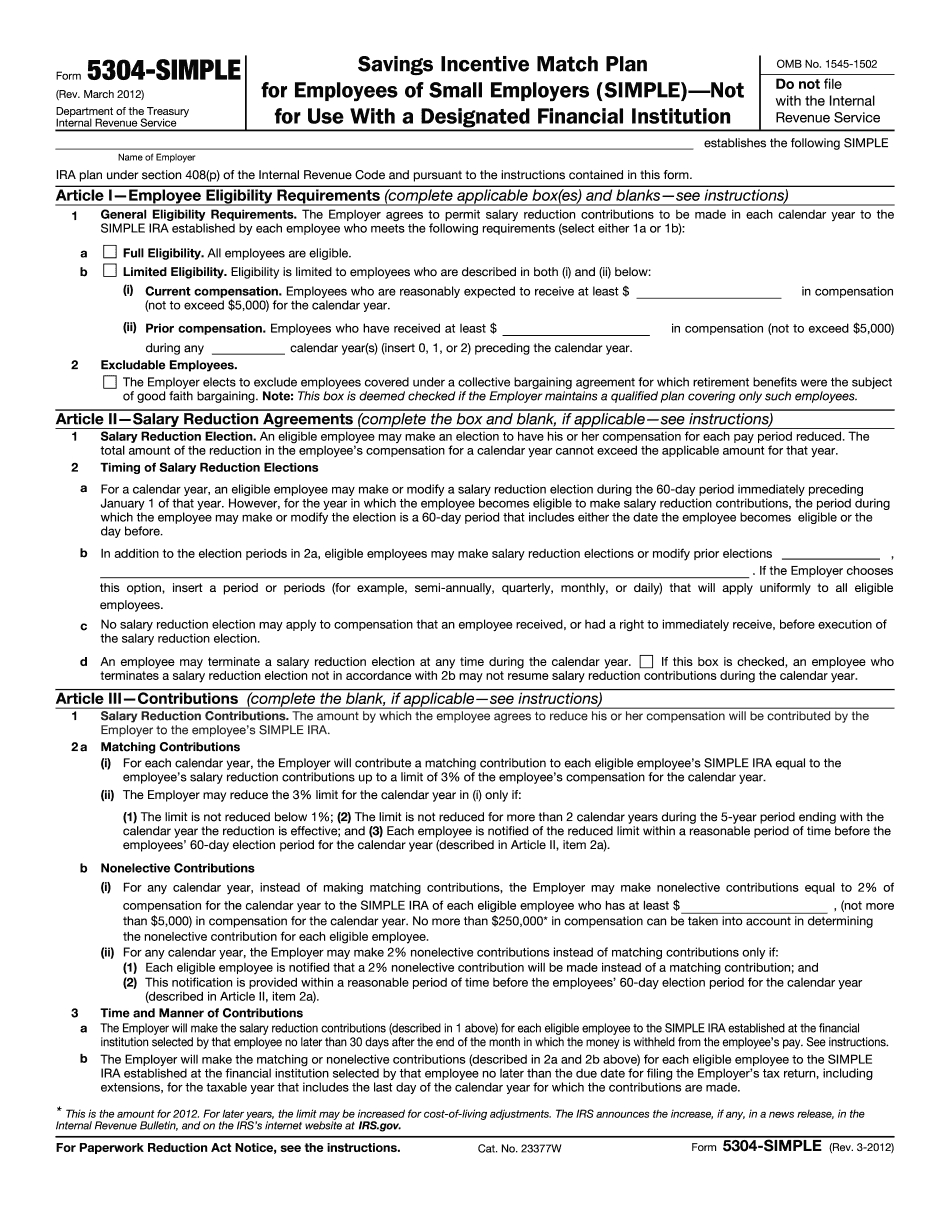

Indy — Feeder Investment Management the preceding calendar year was greater than 100 % of the average amount paid to the staff at the time the SIMPLE was established. 2. Eligibility Limitations. The Employee will qualify for a SIMPLE IRAs only if the Company is registered through the INDEXED system (a private matching system operated by the Internal Revenue Service. See 3. Participation. The SIMPLE plan will provide matching contributions only if two or more employees were at the same firm on the date the plan was established and contributed to the SIMPLE at the same 4. The Contributions. Contributions will be made monthly by a payroll provider to the SIMPLE IRA plan account 5. The Contribution Amounts. All contributions and salary reduction contributions made in a 6. Qualifying Employment. Contributions can only be made to the SIMPLE IRA from a “qualifying employment” that does not include self-employment income or self-employment expenses. See IRS Form 5304-SIMPLE — Formal and IRM 25.6.4.30, Qualifying Employment. 7. Terminated Employment. A terminated employee can designate in his or her SIMPLE IRA plan to receive, instead of and in 8. SIMPLE IRA contribution. SIMPLE IRA plan contributions (from the employees' own payroll receipts) may not be used to 9. Other IRA Contributions. The SIMPLE IRA contribution must be made to an “OTHER IRA”. This is for another person who was contributing to or contributing at the same time and is entitled to benefits. Form 5304-SIMPLE (Rev March 2012) — IRS Form 5304-SIMPLE is a model Savings Incentive Match Plan for Employees of Small Employers (SIMPLE) plan document that an employer may use to establish a SIMPLE 10. Contribution Rules The amount of the SIMPLE IRA portion of the plan as modified by the SIMPLE IRA Plan Document is equal to the employee's contributions over the course of two years from the date the payment is initially made. Additional payroll deductions for SIMPLE IRA plan contributions may only be made after the two-year period during which the employee's contribution was being made. 11.

Online methods assist you to arrange your doc management and supercharge the productiveness within your workflow. Go along with the short guideline to be able to complete Form 5304-SIMPLE Carmel Indiana, keep away from glitches and furnish it inside a timely method:

How to complete a Form 5304-SIMPLE Carmel Indiana?

- On the web site along with the sort, click Commence Now and go to your editor.

- Use the clues to complete the suitable fields.

- Include your personal info and contact data.

- Make certainly that you simply enter right knowledge and numbers in ideal fields.

- Carefully verify the articles from the type in addition as grammar and spelling.

- Refer to aid portion for those who have any queries or tackle our Assistance team.

- Put an digital signature on your Form 5304-SIMPLE Carmel Indiana aided by the enable of Indicator Instrument.

- Once the form is completed, push Finished.

- Distribute the all set variety by means of e-mail or fax, print it out or help save on the product.

PDF editor allows you to make adjustments with your Form 5304-SIMPLE Carmel Indiana from any world-wide-web connected equipment, personalize it in line with your requirements, indication it electronically and distribute in several methods.