Award-winning PDF software

Form 5304-SIMPLE for Waterbury Connecticut: What You Should Know

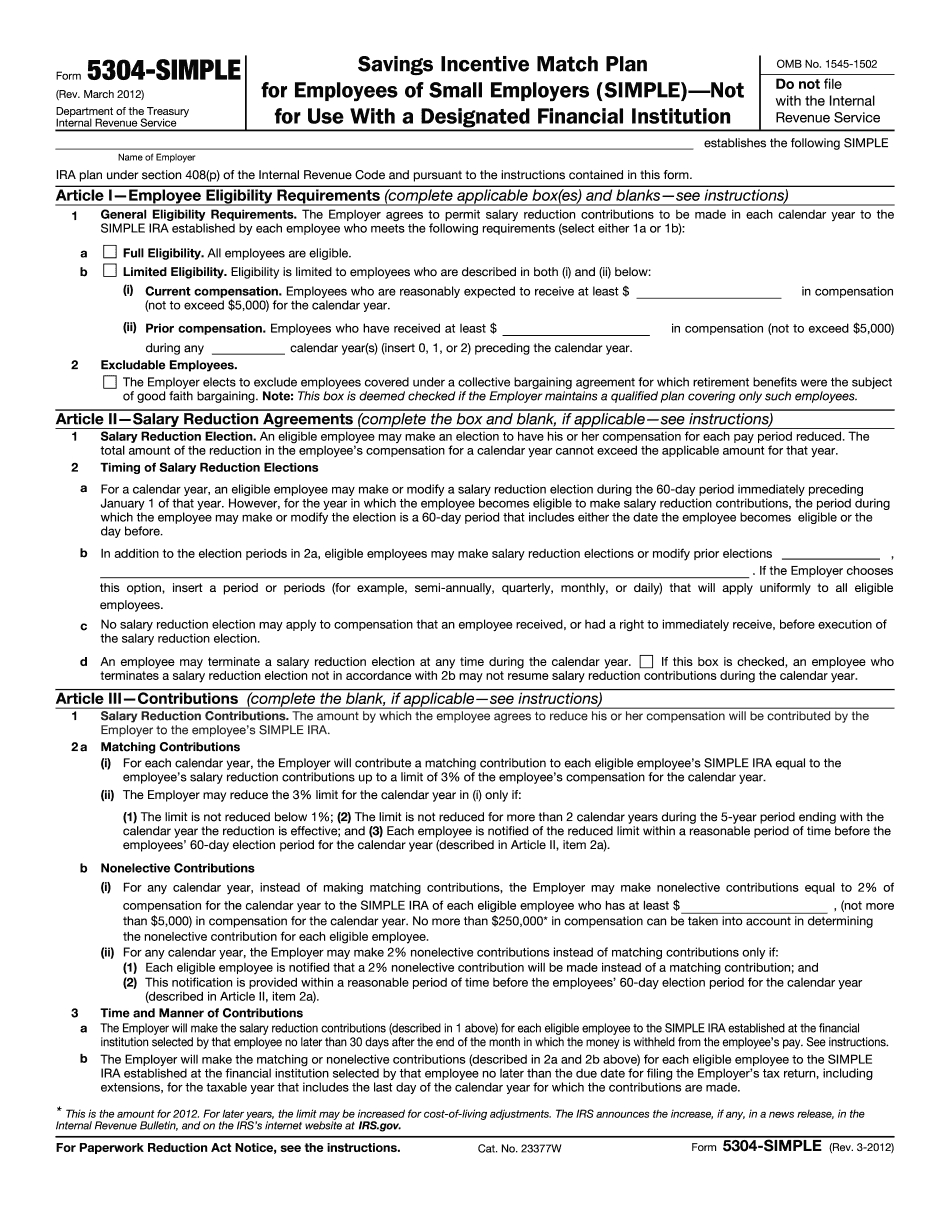

SIMPLE IRA to participate in the same plan as SIMPLE IRA participants, thereby facilitating their efforts to qualify as an employer-sponsored retirement plan in which individuals may establish or contribute to a SIMPLE IRA account. This document explains the purpose and effect of this IRA agreement, as well as its benefits to other employees participating in the same SIMPLE IRA as employees who are not participating in the SIMPLE IRA. This document was written by Mr. David C. Cagney, Sr. The purpose of this form is to help employees establish/contribute to a SIMPLE IRA account when they are not using a SIMPLE IRA. Also note here the “Other Information” section which says as a “request for comments,” we are asking people to post in here any other questions they have regarding this agreement. (We know the document was created in 2025 but are the comments still relevant?) — Thanks to Scott. Tax Information; Personal Tax Returns — Personal Tax Returns Personal Tax Returns — Retirement Personal Tax Returns — Retirement “For all plans in which an eligible individual participates, the employer agrees to make contributions to the eligible individual's account or account number of interest (including earnings) and accrual for the taxable year in which the eligible individual began work (or, if that is not always applicable, for the taxable year in which the eligible individual begins using the plan) and/or in the case of an employee, at least annually through the date the employee reaches age 55. This agreement is subject to the following limitations and conditions: (1) No contribution to plan assets may be made under the table of personal exemptions, any other tax-free personal exemption of that amount or any other personal exemption not equal to the taxable income exclusion available to the taxpayer in the plan. This is true even if any employer matching contribution is made to the plan. (2) At any time during the plan year, an employer may make a deduction for the taxable year in which an eligible individual completes a full-time period of employment or, at the discretion of the employer, the prior year. (3) The employer is not permitted to establish a SIMPLE plan as a benefit to an employee through the use of the personal exemption, a personal exemption of a lesser amount, or an employer contribution to the personal exemption for an employee and/or beneficiary.

Online methods assist you to arrange your doc management and supercharge the productiveness within your workflow. Go along with the short guideline to be able to complete Form 5304-SIMPLE for Waterbury Connecticut, keep away from glitches and furnish it inside a timely method:

How to complete a Form 5304-SIMPLE for Waterbury Connecticut?

- On the web site along with the sort, click Commence Now and go to your editor.

- Use the clues to complete the suitable fields.

- Include your personal info and contact data.

- Make certainly that you simply enter right knowledge and numbers in ideal fields.

- Carefully verify the articles from the type in addition as grammar and spelling.

- Refer to aid portion for those who have any queries or tackle our Assistance team.

- Put an digital signature on your Form 5304-SIMPLE for Waterbury Connecticut aided by the enable of Indicator Instrument.

- Once the form is completed, push Finished.

- Distribute the all set variety by means of e-mail or fax, print it out or help save on the product.

PDF editor allows you to make adjustments with your Form 5304-SIMPLE for Waterbury Connecticut from any world-wide-web connected equipment, personalize it in line with your requirements, indication it electronically and distribute in several methods.