Award-winning PDF software

Form 5304-SIMPLE Vancouver Washington: What You Should Know

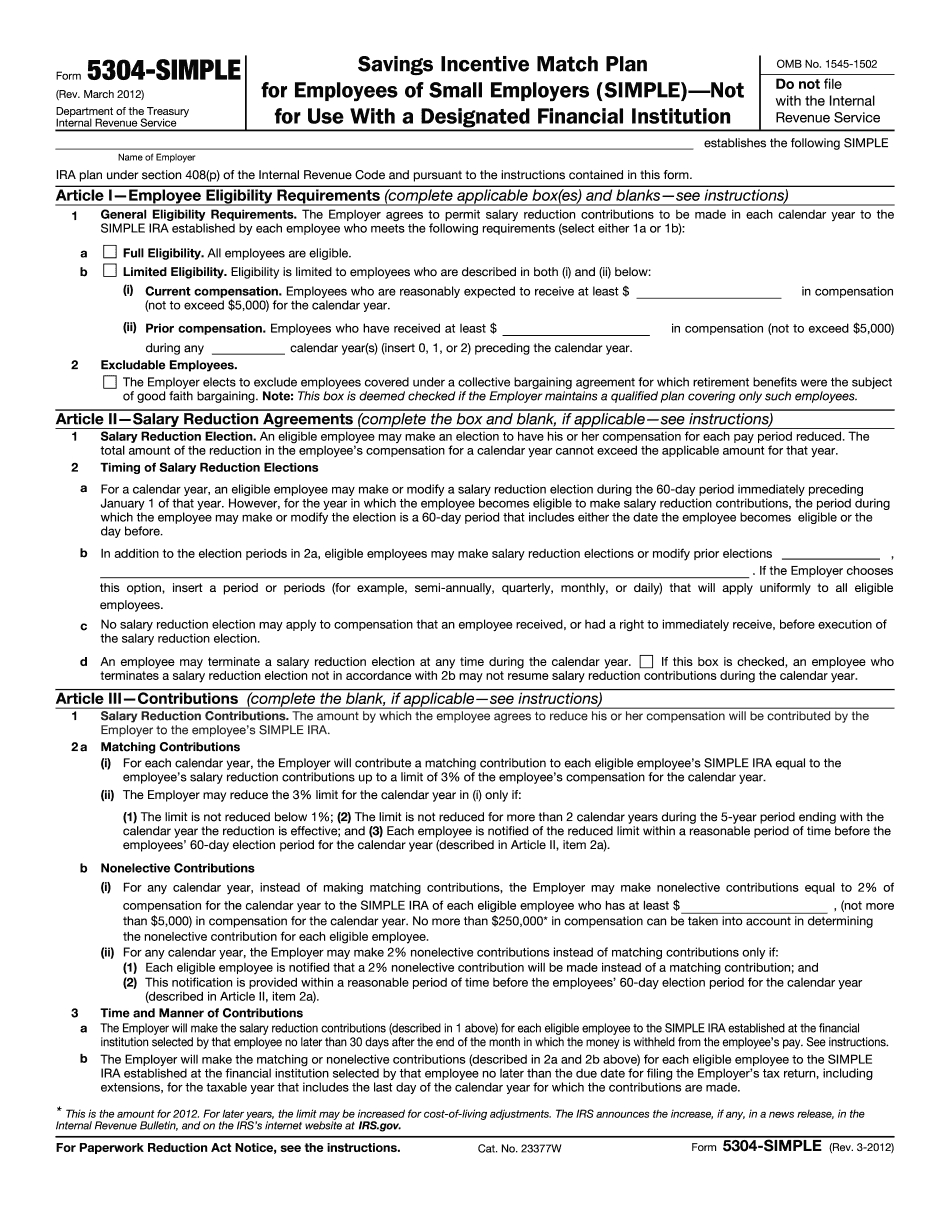

SIMPLE IRA plans to contribute to an IRA account and maintain it in compliance with IRS regulations on IRA accounts. Individuals can establish an agreement or contract for SIMPLE IRA plans using this IRS Form 5304-SIMPLE. This form does not authorize the employer. This form allows the employee to elect, or permit the employer or any of its financial advisors to establish, a SIMPLE IRA Plan for him/her. SIMPLE IRA is used at the discretion of the employer, but cannot be established without the prior approval of the IRS. An IRA is a retirement plan used by people who are not participating in a pension plan. An IRA may be set up with a retirement investment plan (such as a 403(b) or a 401(k)) or with a pre-tax IRA or SIMPLE IRA plan. A qualified retiree receives a tax deduction for contributions, interest, and investment earnings in an IRA. The SIMPLE IRA plan requires the participant to enroll in one of the SIMPLE IRA plans. The IRA benefits may be contributed, deposited, and distributed as a lump sum or over a period of years and can be invested in bonds or mutual funds. An individual can only contribute up to a total of 5,500 annually. Any unused contributions are allowed to be carried over to the next year for an employer plan. The SIMPLE IRA plan has been in effect in Washington state for a number of years. The following is a summary of the major participants of the SIMPLE IRA: Employee Plans : The employee selects the benefit plan that contains the SIMPLE IRA plan. The employee has the option to opt out of the retirement plan if the employee desires. For an employer plan that is subject to 401(k) requirements and is established and maintained by the employer, the employer is responsible for making the plans contributions and investment decisions. The employer cannot make a SIMPLE IRA plan (or any other plan that does not meet the requirements of the rules) or establish or permit anyone else to establish a SIMPLE IRA plan without the prior approval of the IRS. You may provide your own personal information for an employee plan, including your name, position, and other personal information. Employer Plans : The employer establishes and maintains the SIMPLE IRA plan. The employer is not responsible to fund the SIMPLE IRA plan. Employee Plans : The employee selects the plan that contains the SIMPLE IRA plan.

Online methods assist you to arrange your doc management and supercharge the productiveness within your workflow. Go along with the short guideline to be able to complete Form 5304-SIMPLE Vancouver Washington, keep away from glitches and furnish it inside a timely method:

How to complete a Form 5304-SIMPLE Vancouver Washington?

- On the web site along with the sort, click Commence Now and go to your editor.

- Use the clues to complete the suitable fields.

- Include your personal info and contact data.

- Make certainly that you simply enter right knowledge and numbers in ideal fields.

- Carefully verify the articles from the type in addition as grammar and spelling.

- Refer to aid portion for those who have any queries or tackle our Assistance team.

- Put an digital signature on your Form 5304-SIMPLE Vancouver Washington aided by the enable of Indicator Instrument.

- Once the form is completed, push Finished.

- Distribute the all set variety by means of e-mail or fax, print it out or help save on the product.

PDF editor allows you to make adjustments with your Form 5304-SIMPLE Vancouver Washington from any world-wide-web connected equipment, personalize it in line with your requirements, indication it electronically and distribute in several methods.