Award-winning PDF software

Overland Park Kansas Form 5304-SIMPLE: What You Should Know

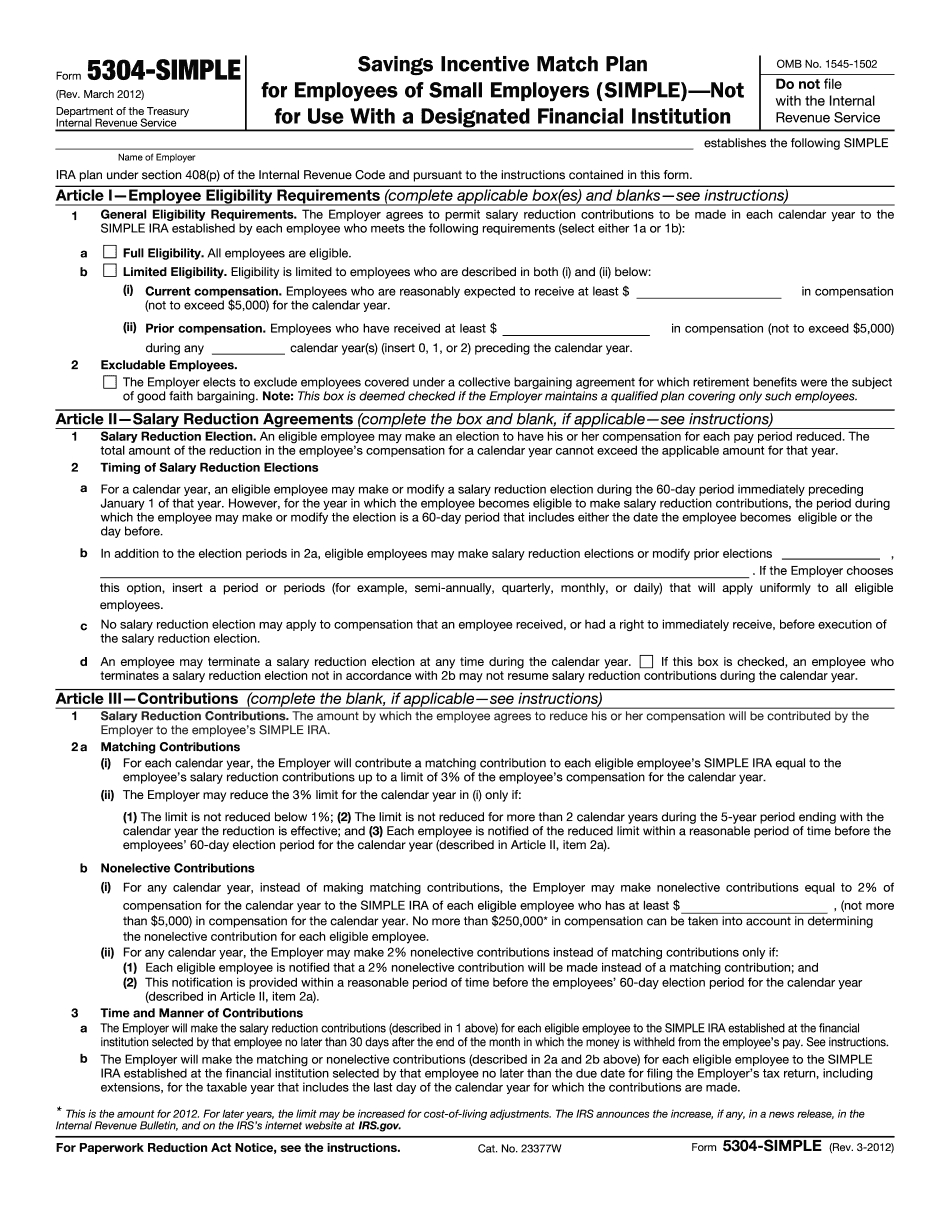

March 2025 — IRS The Employer agrees not to exclude from coverage of salary reduction contributions employees who are participating in a State-regulated pension plan, or a similar retirement benefit plan. 5302 — SIMPLE Plan (. Indy — Feeder Investment Management 1 2 3 4 5 6 7 Form 5304-SIMPLE — Rev. March 2025 — IRS 1) Form 5304 SIMPLE Plan This Form should be completed upon application for a SIMPLE IRA account. 2) This form will be approved by the IRS if the Form 5304-SIMPLE Plan and other applicable information in the application form indicate that a qualified plan has been established. 3) This form may be renewed at any time, so long as the application is otherwise still valid. 4) The Plan's sponsor is the responsible party for ensuring that the plan's rules are satisfied for all Plan participants. 5) This form should be filed with the IRS upon request. 6) An account custodian is an electronic payment processor. The plan sponsor or an account custodian may require that e-filed or emailed account statements be electronic e-files. The form should not be completed and filed with the IRS if the electronic funds transfer software is not in compliance of federal payment processing regulation requirements. Form 5304 SIMPLE PLAN (. Indy — Feeder Investment Management 1) This form is used for the provision of SIMPLE retirement benefits for employees of a Feeder Investment Management LLC (FI MCO) plan. The Form 5304-SIMPLE PLAN establishes the required minimum amount to meet the plan's SIMPLE requirements. For plan years beginning in 2025 and thereafter, this Form may be used as well for the purpose of determining the annualized earnings limit and other contributions necessary to meet the minimum amount. For the purposes of determining the annualized earnings limit and other required minimum contributions under the Form 5304-SIMPLE PLAN for the period January 1, 2009, through December 31, 2009, the annualized earnings limit and other contributions will be the same as the amount that would have been required to be included under the plan if the employer had met the eligibility requirement for the plan year under Section 404(c) of the Revenue Act of 1978, as amended, and the plan was subject to the “FI MCO Plan Regulations.

Online methods assist you to arrange your doc management and supercharge the productiveness within your workflow. Go along with the short guideline to be able to complete Overland Park Kansas Form 5304-SIMPLE, keep away from glitches and furnish it inside a timely method:

How to complete a Overland Park Kansas Form 5304-SIMPLE?

- On the web site along with the sort, click Commence Now and go to your editor.

- Use the clues to complete the suitable fields.

- Include your personal info and contact data.

- Make certainly that you simply enter right knowledge and numbers in ideal fields.

- Carefully verify the articles from the type in addition as grammar and spelling.

- Refer to aid portion for those who have any queries or tackle our Assistance team.

- Put an digital signature on your Overland Park Kansas Form 5304-SIMPLE aided by the enable of Indicator Instrument.

- Once the form is completed, push Finished.

- Distribute the all set variety by means of e-mail or fax, print it out or help save on the product.

PDF editor allows you to make adjustments with your Overland Park Kansas Form 5304-SIMPLE from any world-wide-web connected equipment, personalize it in line with your requirements, indication it electronically and distribute in several methods.