Award-winning PDF software

Printable Form 5304-SIMPLE Charlotte North Carolina: What You Should Know

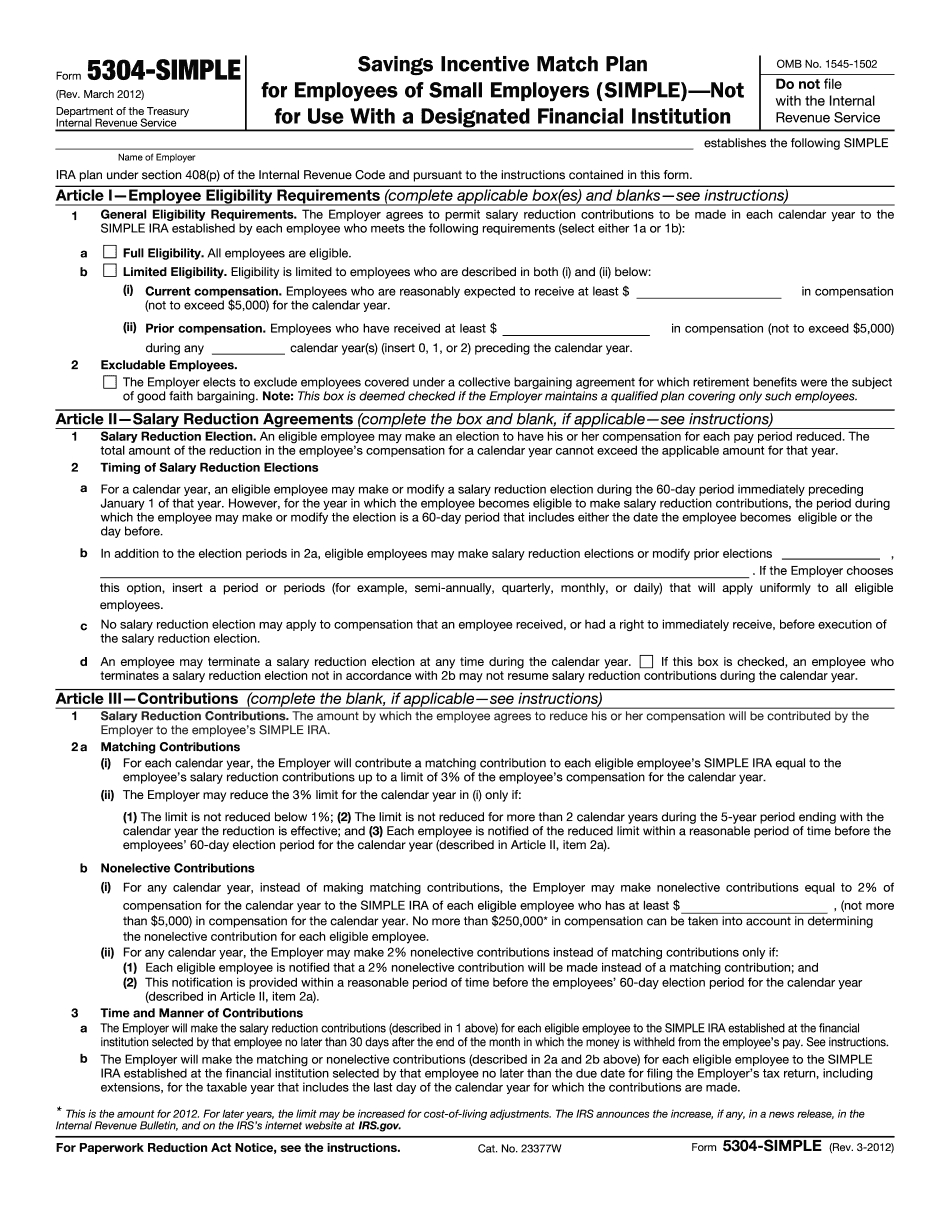

In your city: You would be responsible for the filing of the 5304. This document must be filed with the State Insurance Commissioner's office and deposited into the State General Fund. For Paperwork Reduction Act Notice, see the instructions. 2. Salary Reduction Contributions. Eligible employees will be eligible to make their maximum allowable salary reduction contribution, which is based on all salary reduction contributions to the SIMPLE IRA for the preceding calendar year, in each calendar year. This contribution may be made by written letter, and may be made up to three times before the SIMPLE IRA is subject to the 5% limit and at the discretion of the company's board of directors. Eligible employees who make any salary reduction contribution in an employee's personal account prior to April 1st will not be eligible to make a salary reduction contribution in that individual's SIMPLE IRA. (This means that if an individual is employed by a corporation who establishes a salary reduction “plan”, that individual will be able to be reimbursed for the cost of his salary reduction contributions in the corporate SIMPLE IRA until April 1st) 3. Employer's Role. Upon approval of this form the SIMPLE IRA will begin offering and accepting salary reduction contributions in the following year. Any salary reduction contributions made during or after this year should only be made under a separate contract between the employer and employee. An annual maximum of 100 is required in the taxable year for each employee who makes salary reduction contributions during the year. For purposes of calculating maximum salary reduction contributions an aggregate maximum of 200 is provided in the 5304. 3a. Eligibility Criteria. Eligible employees must maintain an account in a brokerage company that provides the same types of investment management services offered by the company. Such services include investment research, stock trading, exchange brokerage, mutual fund and ETF management, tax research (including tax planning related to the investment vehicles utilized as part of the portfolio), and tax planning, among others. Employees will be required to complete at least two online portfolios each year, which are based on a stock market index and a diversified index fund. The online portfolio has a maximum holding period of one year and, if applicable, a fixed asset investment limit or range for which the minimum and maximum asset values are established by the company.

Online methods assist you to arrange your doc management and supercharge the productiveness within your workflow. Go along with the short guideline to be able to complete Printable Form 5304-SIMPLE Charlotte North Carolina, keep away from glitches and furnish it inside a timely method:

How to complete a Printable Form 5304-SIMPLE Charlotte North Carolina?

- On the web site along with the sort, click Commence Now and go to your editor.

- Use the clues to complete the suitable fields.

- Include your personal info and contact data.

- Make certainly that you simply enter right knowledge and numbers in ideal fields.

- Carefully verify the articles from the type in addition as grammar and spelling.

- Refer to aid portion for those who have any queries or tackle our Assistance team.

- Put an digital signature on your Printable Form 5304-SIMPLE Charlotte North Carolina aided by the enable of Indicator Instrument.

- Once the form is completed, push Finished.

- Distribute the all set variety by means of e-mail or fax, print it out or help save on the product.

PDF editor allows you to make adjustments with your Printable Form 5304-SIMPLE Charlotte North Carolina from any world-wide-web connected equipment, personalize it in line with your requirements, indication it electronically and distribute in several methods.