Award-winning PDF software

Rancho Cucamonga California Form 5304-SIMPLE: What You Should Know

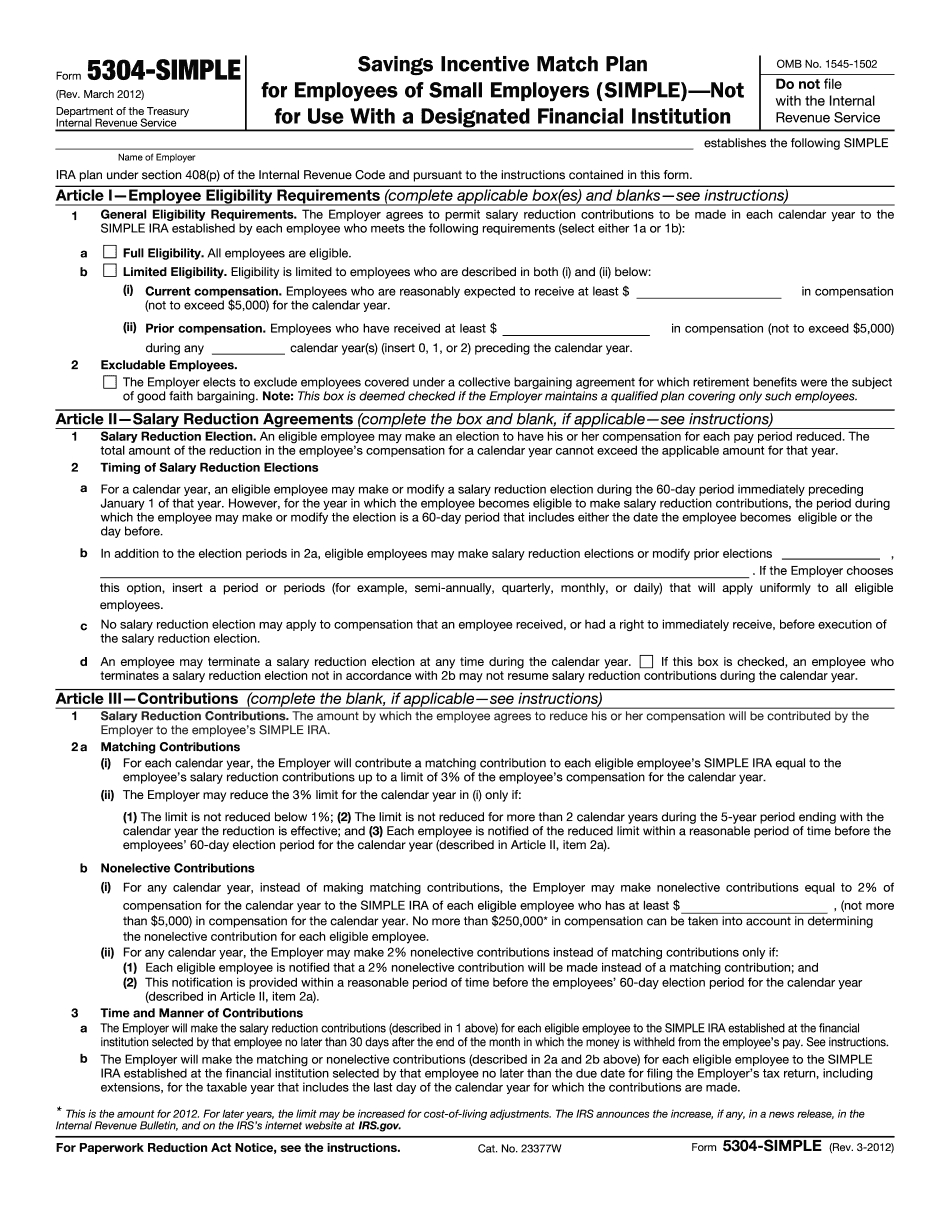

It is designed for small businesses in low to moderate tax jurisdictions. In your state? Check out our state and/or city guides! IRS Forms 5304 and 5405 Offers Special Tax Relief for Retirement Plans IRR #5304 offers special tax relief from an excise tax of 10%. IRC Section 6701 allows individuals to treat their IRAs as “retirement” accounts. IRR #5405 and IRR #5110 offer special tax relief for retirement plans. IRR #5110 and IRR #5110 Offer Special Tax Relief by Eliminating the 3% Excise Tax These IRS have several tax advantages. One is by eliminating the 3% federal excise tax on qualified retirement plans. This is good news! The 3% tax applies only to employee and employer plan contributions, not self-employed 401K contributions (the employer portion of the plan is not subject to the 3% tax). IRR #5110, Special Tax Relief for Retirement Plans, Is Not a “Retirement Plan” Tax Break for “Retirement” IRR #5110 is a special tax relief for retirement plans, not a “retirement” tax break, and, as such, does not qualify as a tax break for “retirement”. Also, if you make contributions, you must itemize your deductions. This can be quite complicated for large businesses. For small or medium businesses, this is easy. A SIMPLE IRA Plan is very similar to, and is tax-free, of course, just as a 401K for employees. However, there is more to a SIMPLE IRA than just retirement. For example, this includes IRAs with multiple accounts, employee trusts for employees, and special rules for certain types of pensions. See our individual guidance or the IRS website for more detail. IRR #5104 Offer Special Tax Relief for Retirement Plans as a Subpart F Pension Plan A SIMPLE Plan created as a “subpart F” (or “subpart C”) pension plan, for the purposes of IRC Section 8401, is tax-free. For a SIMPLE, the plan must be established, maintained, administered and available for vesting, within the calendar portion of the five-year plan year that begins after the tax year to which it is transferred.

Online methods assist you to arrange your doc management and supercharge the productiveness within your workflow. Go along with the short guideline to be able to complete Rancho Cucamonga California Form 5304-SIMPLE, keep away from glitches and furnish it inside a timely method:

How to complete a Rancho Cucamonga California Form 5304-SIMPLE?

- On the web site along with the sort, click Commence Now and go to your editor.

- Use the clues to complete the suitable fields.

- Include your personal info and contact data.

- Make certainly that you simply enter right knowledge and numbers in ideal fields.

- Carefully verify the articles from the type in addition as grammar and spelling.

- Refer to aid portion for those who have any queries or tackle our Assistance team.

- Put an digital signature on your Rancho Cucamonga California Form 5304-SIMPLE aided by the enable of Indicator Instrument.

- Once the form is completed, push Finished.

- Distribute the all set variety by means of e-mail or fax, print it out or help save on the product.

PDF editor allows you to make adjustments with your Rancho Cucamonga California Form 5304-SIMPLE from any world-wide-web connected equipment, personalize it in line with your requirements, indication it electronically and distribute in several methods.