Award-winning PDF software

Rialto California online Form 5304-SIMPLE: What You Should Know

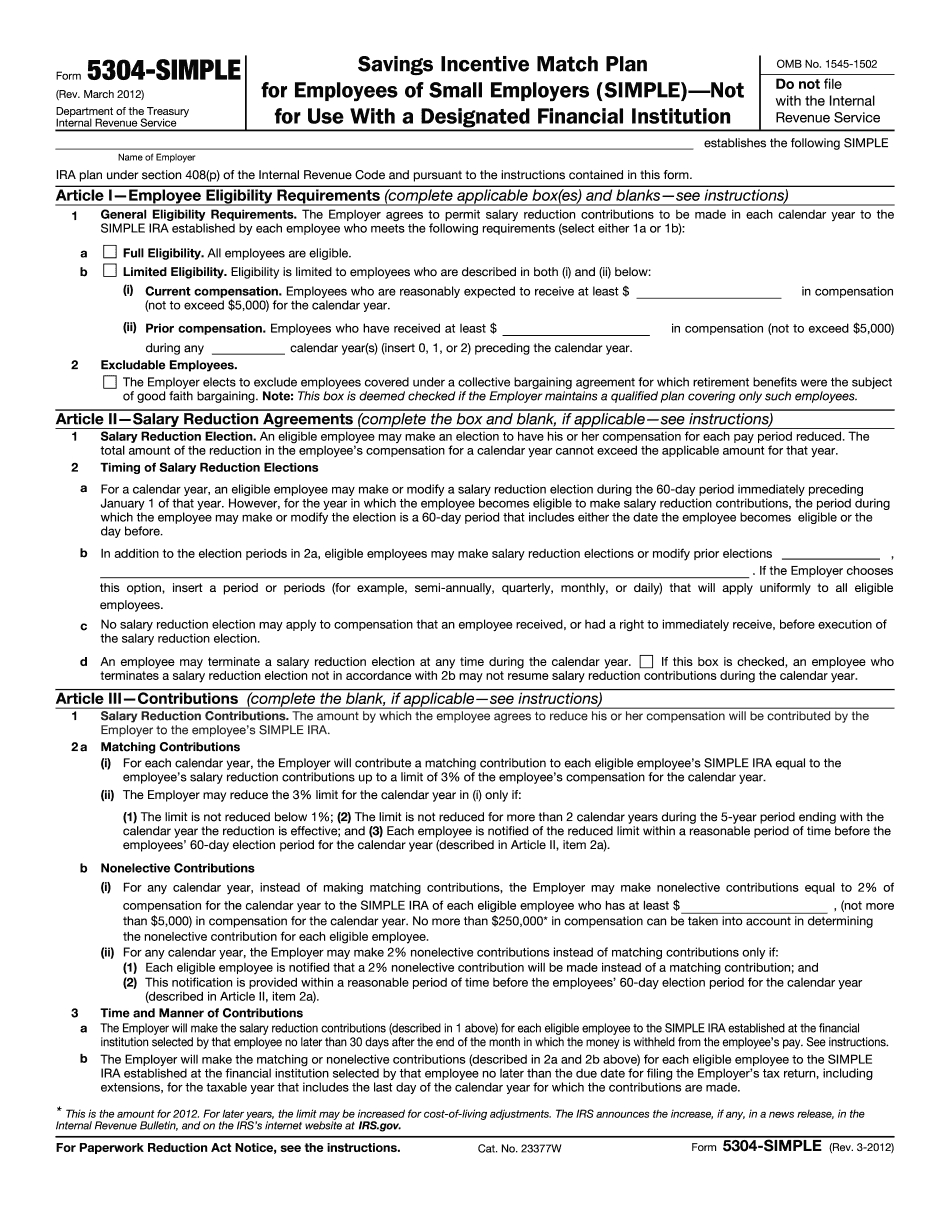

As previously reported in the Tempe City Council meeting of April 13, 2016, several temporary positions have been filled on a temporary basis and then were brought to full employment. While the City was attempting to identify additional temporary positions, it was also seeking to establish a new employment system for the City. Due to the complexity of the new system, new positions were not identified and thus, the temporary personnel positions on January 1, 2017, were replaced by a temporary system employment staff. In compliance with Government Code sections 12463, 53892, and AB 2040, the City filed, with the California State Controller's office, various compensation statements of expense. As previously reported in the Tempe City Council meeting of April 13, 2016, several a temporary positions have been filled on a temporary basis and then were brought to full employment. While the City was attempting to identify additional temporary positions, it was also seeking to establish a new employment system for the City. Due to the complexity of the new system, new positions were not identified and thus, the temporary personnel positions on January 1, 2017, were replaced by a temporary system employment staff. See City of Tempe Employment System Changes, Tempe Gazette, and the Tempe City Council meeting of April 13, 2016. Employer Contributions and matching benefits The Employer is required to make payroll contributions annually. The Employer must satisfy the following three criteria when establishing Employee contributions and matching benefits: Employee must earn minimum annual earnings with minimum earnings for the employee's first employment. For employees that earned less than 3,000 before the start date of employment, or 3,000 with no experience and less than 12 months of employment, an additional 10 % must be added The Employer and any employee organization contributing to the plan cannot have a common or prohibited employer. Employee must be eligible, and receive a reasonable amount of pay for the period of employment required. For employees that earned less than 11.00 an hour (or 12,000 with 3 or fewer years of employment) an additional 20% may be added In accordance with section 401 of ERICA, the Employer must pay the matching contribution.

Online methods assist you to arrange your doc management and supercharge the productiveness within your workflow. Go along with the short guideline to be able to complete Rialto California online Form 5304-SIMPLE, keep away from glitches and furnish it inside a timely method:

How to complete a Rialto California online Form 5304-SIMPLE?

- On the web site along with the sort, click Commence Now and go to your editor.

- Use the clues to complete the suitable fields.

- Include your personal info and contact data.

- Make certainly that you simply enter right knowledge and numbers in ideal fields.

- Carefully verify the articles from the type in addition as grammar and spelling.

- Refer to aid portion for those who have any queries or tackle our Assistance team.

- Put an digital signature on your Rialto California online Form 5304-SIMPLE aided by the enable of Indicator Instrument.

- Once the form is completed, push Finished.

- Distribute the all set variety by means of e-mail or fax, print it out or help save on the product.

PDF editor allows you to make adjustments with your Rialto California online Form 5304-SIMPLE from any world-wide-web connected equipment, personalize it in line with your requirements, indication it electronically and distribute in several methods.