Award-winning PDF software

Printable Form 5304-SIMPLE Nassau New York: What You Should Know

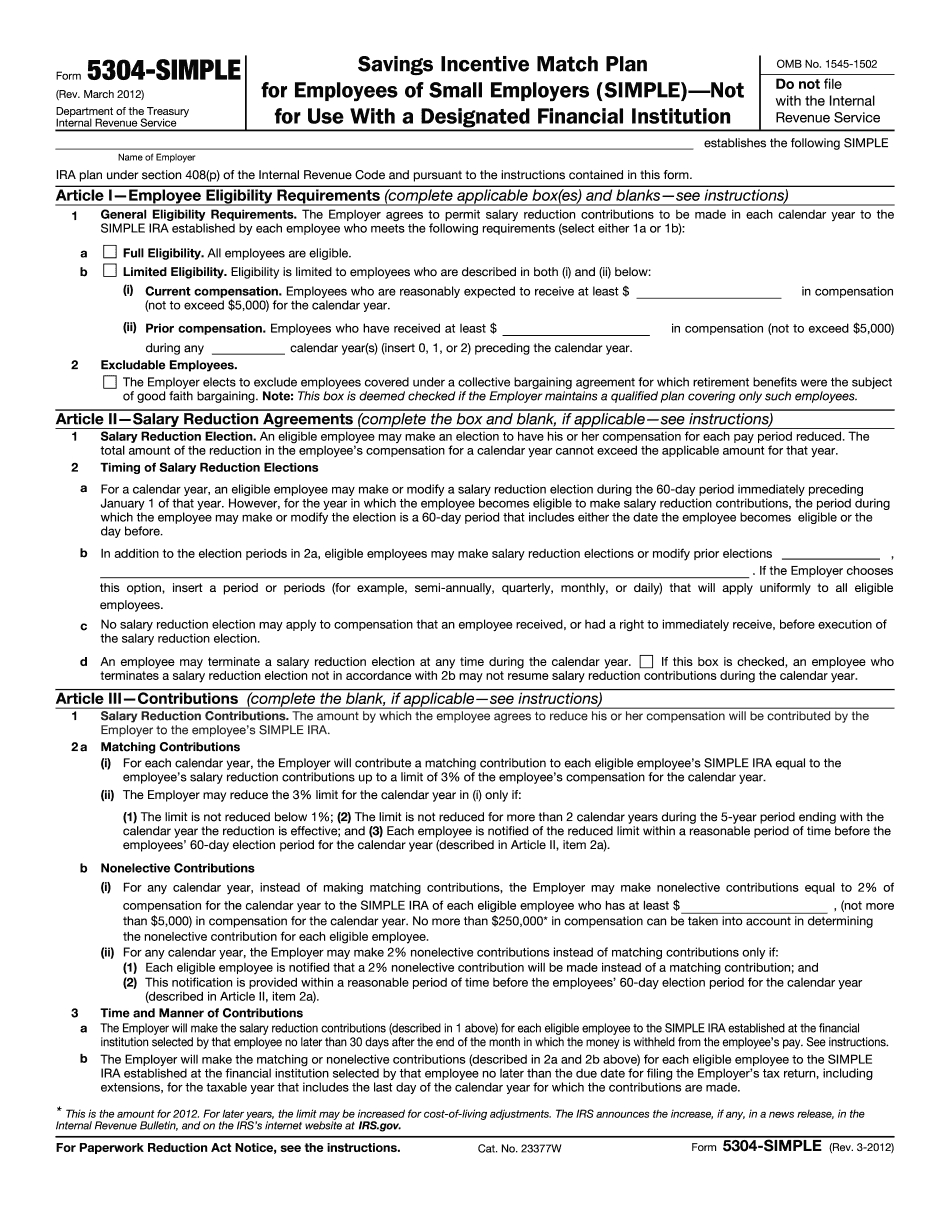

This information should not be copied, altered or distributed without the express written permission of the author (2) Copies should not be made available to anyone else, including any affiliate of International Code Council (3) Any questions about this document should be directed to the author on Facebook (4) This document is also pursuant to Article XXI, Section 5 of the New York State Charter of Human Rights and Freedoms and is part of the New York Code of Business, Tax & Finance, Article 8, Section 810. 2. Purpose and Scope. The purpose of this provision is to establish a new and simpler tax-exempt retirement plan, not involving any investment of any type, which a business entity must be prepared to establish and administer, and to assure that a business entity is not required to bear a financial burden in connection with the administration of the plan, because of the limited amount of assets of the business entity available for the operation of the plan. The scope of the provision is as follows: (1) A business entity that is engaged in a legitimate business for the operation of its business premises or property shall make contributions, under a SIMPLE IRA, to a New York State SIMPLE IRA, and if required, is to maintain the funds in New York State. Contributions may be made on behalf of the business entity by persons authorized to make contributions, and in the manner and form and to the extent as described in the SIMPLE IRA plan. In lieu of making contributions, the business entity shall be a Participating Business, in which case all the requirements of this Article, except that the business entity would not be required to be a participant for the purpose of the New York State SIMPLE IRA plan but merely be treated as a participant for purposes of filing federal tax returns under Section 402, for the purpose of Section 401(a)(27) plans, and for purposes of the American Health Security Act, as amended. Such businesses may choose to comply with the New York State SIMPLE IRA plan in accordance with the SIMPLE IRA Plan Description, or any portion of it.

Online methods assist you to arrange your doc management and supercharge the productiveness within your workflow. Go along with the short guideline to be able to complete Printable Form 5304-SIMPLE Nassau New York, keep away from glitches and furnish it inside a timely method:

How to complete a Printable Form 5304-SIMPLE Nassau New York?

- On the web site along with the sort, click Commence Now and go to your editor.

- Use the clues to complete the suitable fields.

- Include your personal info and contact data.

- Make certainly that you simply enter right knowledge and numbers in ideal fields.

- Carefully verify the articles from the type in addition as grammar and spelling.

- Refer to aid portion for those who have any queries or tackle our Assistance team.

- Put an digital signature on your Printable Form 5304-SIMPLE Nassau New York aided by the enable of Indicator Instrument.

- Once the form is completed, push Finished.

- Distribute the all set variety by means of e-mail or fax, print it out or help save on the product.

PDF editor allows you to make adjustments with your Printable Form 5304-SIMPLE Nassau New York from any world-wide-web connected equipment, personalize it in line with your requirements, indication it electronically and distribute in several methods.