Award-winning PDF software

CO online Form 5304-SIMPLE: What You Should Know

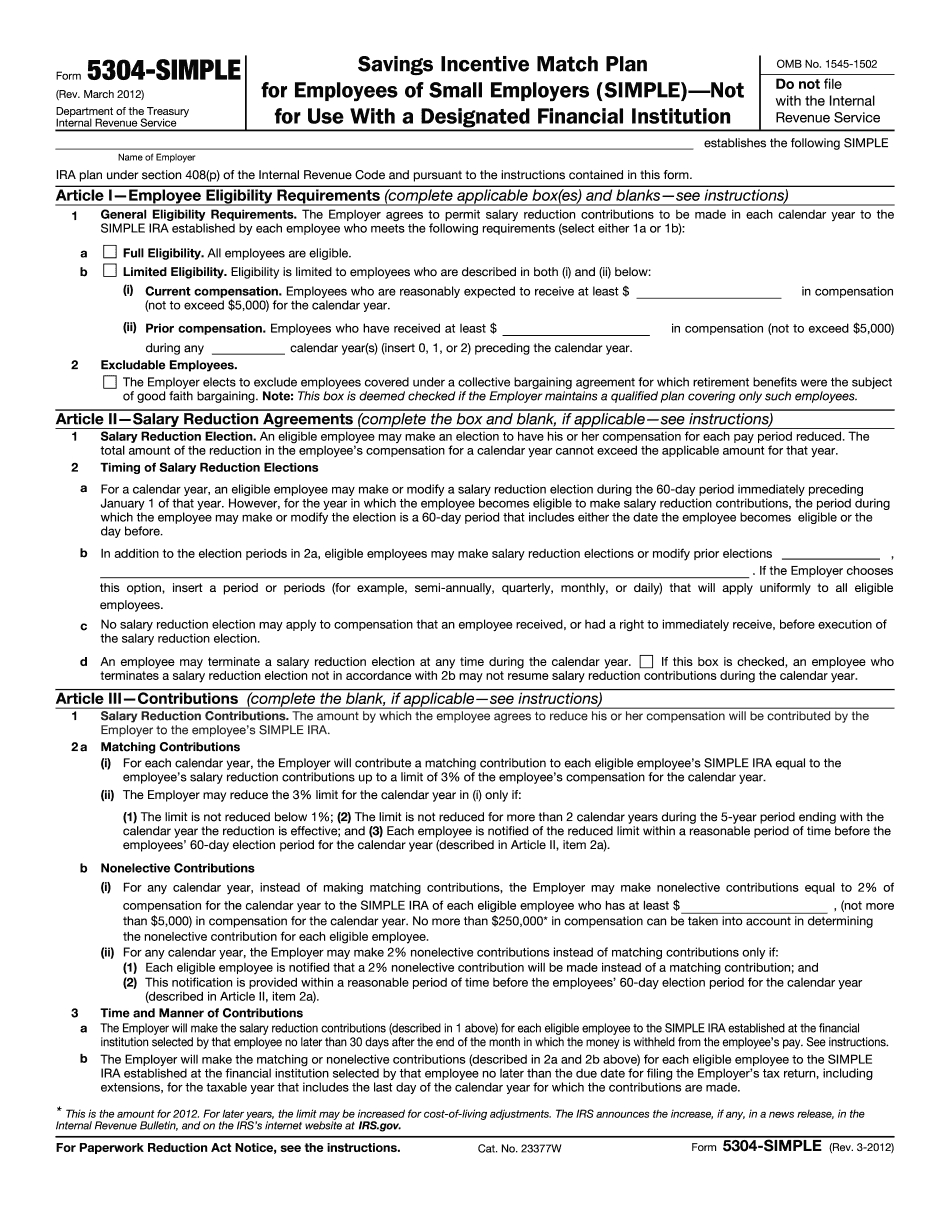

Plan Participants. SIMPLE IRA Plan and Employer Guides SIMPLE IRA Employer Guide — Alliance Bernstein SIMPLE IRA Employer Guide — Lord Abbott Instructions. If you cannot find the IRS Form 5304-SIMPLE company profile that corresponds to the company name you will need to find the employee designation that relates to the company name. If you cannot find the employee designation on the company Profile, use the appropriate designation on the SIMPLE IRA Employer Guide. Step 11 Enter the employee designation on the SIMPLE IRA Employer Guide Complete IRS Form 5304-SIMPLE Articles I through VII and Model Notification to. Plan Participants. SIMPLE IRA Plan and Employer Guides SIMPLE IRA Plan — Lord Abbott Signing the SIMPLE IRA Plan and Employee Form Step 12 Enter the SIMPLE IRA Plan Payroll Processing Authorization Form, Federal/State/Local. In the first box: enter the full name of the employer. Enter the street address of business. Enter the telephone number. If there are no locations listed, enter. The second box selects the county from which the employer resides. If the employee is a minor, enter the Social Security number, date of birth, and date of immigration (U.S. Citizenship and Immigration Services). The third box selects the county from which the employee graduated, if the employee is a minor. The last box of the SIMPLE IRA Plan (Form 5304-SIMPLE) contains additional information. In a small business, the purpose of the plan is to provide the employee with a tax-free contribution of pre-tax wages of an amount up to the amount contributed. In a large business the total amount included in employee wages is limited to a certain percentage of earnings. When the employee fails to contribute the minimum amount which may be a result of an inadvertent mistake, the employer is required to withhold the appropriate amount from the payroll. The employee's employer will send a form (Form 5304-SIMPLE) to the employee, by mail, on or before the anniversary of the tax-free contribution amount. The employee's employer will withhold a 10% penalty from the payment for failure to file by the deadline, within the time to request a return. The employer will also pay a penalty of 1/3 of the tax-free contribution amount against the employee's check when the employee does file, with a statement of that fact attached to the check. The employee will receive a separate statement when the employee does not contribute enough.

Online methods assist you to arrange your doc management and supercharge the productiveness within your workflow. Go along with the short guideline to be able to complete CO online Form 5304-SIMPLE, keep away from glitches and furnish it inside a timely method:

How to complete a CO online Form 5304-SIMPLE?

- On the web site along with the sort, click Commence Now and go to your editor.

- Use the clues to complete the suitable fields.

- Include your personal info and contact data.

- Make certainly that you simply enter right knowledge and numbers in ideal fields.

- Carefully verify the articles from the type in addition as grammar and spelling.

- Refer to aid portion for those who have any queries or tackle our Assistance team.

- Put an digital signature on your CO online Form 5304-SIMPLE aided by the enable of Indicator Instrument.

- Once the form is completed, push Finished.

- Distribute the all set variety by means of e-mail or fax, print it out or help save on the product.

PDF editor allows you to make adjustments with your CO online Form 5304-SIMPLE from any world-wide-web connected equipment, personalize it in line with your requirements, indication it electronically and distribute in several methods.