Award-winning PDF software

Form 5304-SIMPLE online Connecticut: What You Should Know

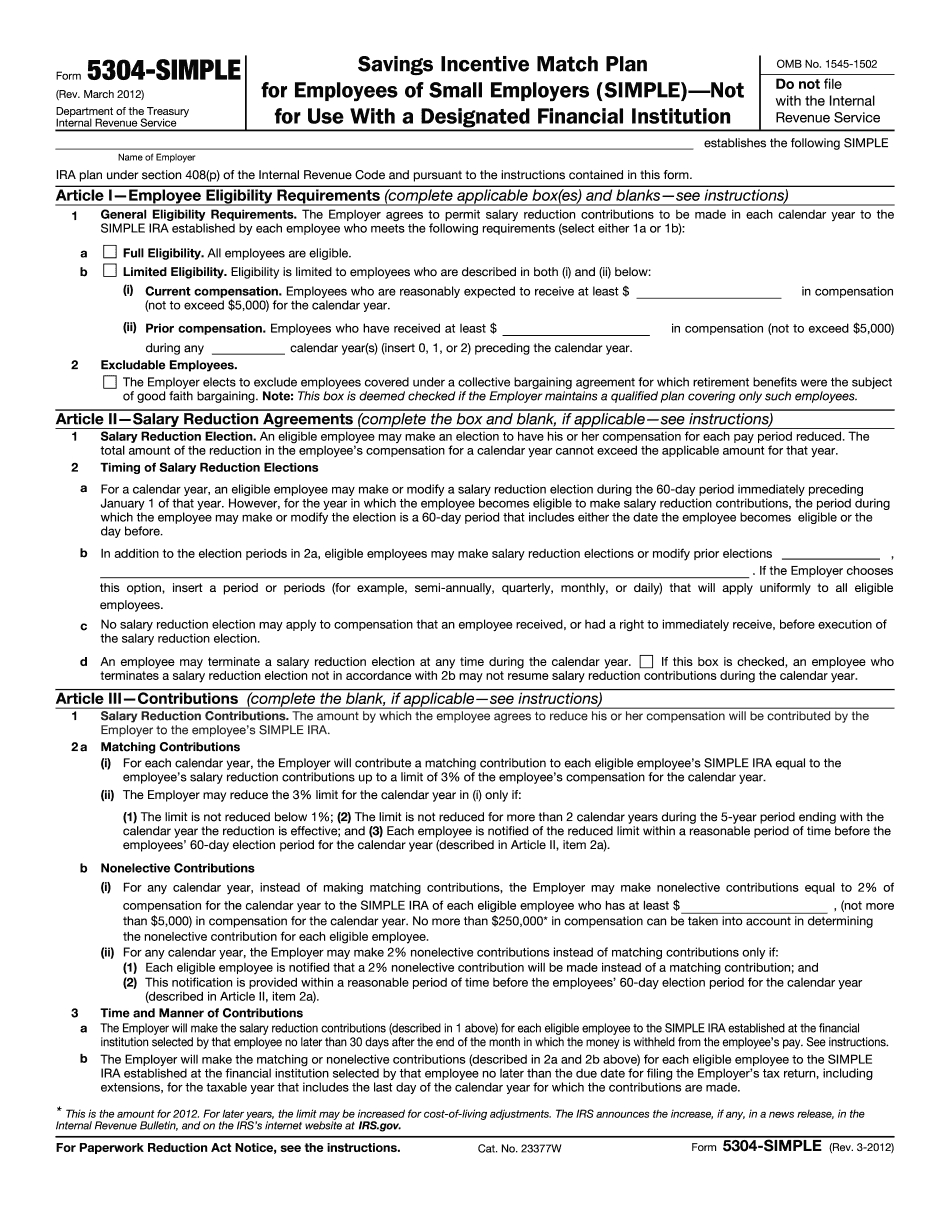

Eric Scott Question — Ed Scott Why are there two forms for the same kind of plan in the form 5604? — Eric Scott I believe because they have two different words — they were doing two different versions of this program. Connecticut SIMPLE Plan — CT.gov What is the procedure for updating an SIMPLE plan and making it SIMPLE? — Ed Scott In Connecticut there isn't a need to amend your SIMPLE plan. All you need to do is file the new SIMPLE and your old SIMPLE plan will be maintained until one year after the beginning of the second plan year. Connecticut SIMPLE Plan — Ed Scott What happens if employee's plan already has a new SIMPLE? — Mike Scott If an employer has already entered into an existing SIMPLE tax year and a new SIMPLE year begins before January 1st of the new plan year, the employer is responsible for making payments, reporting and keeping all existing SIMPLE account information. Connecticut SIMPLE Plan — Ed Scott What is the purpose of the Notice of Change (Form 5304), i.e. what is the purpose for creating a new SIMPLE plan? — Mike Scott The purpose of the Notice of Change forms 5304 – 5305.01C and 5304 – 5305.02C are to provide an explanation of the impact of changes to a SIMPLE plan of which the Plan Sponsor must maintain the old SIMPLE plan. This document is to assist the employer in making changes to the plans to maintain the SIMPLE plan. Connecticut Individual Retirement Account (IRA) Income Tax — Ed Scott What is an IRA? I am wondering if an IRA is taxable. I am wondering if employees have to file federal form 5403 before filing an IRA tax return. — Karen Scott The IRA or individual retirement arrangement is a tax-advantaged account, such as a 401(k), 403(b), or 457 (P) plan, under which an individual(s) may earn or contribute tax-free interest or dividends, after-tax, with no additional tax required to pay. Contributions and earnings in an IRA may be withdrawn tax-free for qualified medical expenses only, and must be withdrawn at least once in each calendar year. IRA contributions are not subject to federal income tax.

Online methods assist you to arrange your doc management and supercharge the productiveness within your workflow. Go along with the short guideline to be able to complete Form 5304-SIMPLE online Connecticut, keep away from glitches and furnish it inside a timely method:

How to complete a Form 5304-SIMPLE online Connecticut?

- On the web site along with the sort, click Commence Now and go to your editor.

- Use the clues to complete the suitable fields.

- Include your personal info and contact data.

- Make certainly that you simply enter right knowledge and numbers in ideal fields.

- Carefully verify the articles from the type in addition as grammar and spelling.

- Refer to aid portion for those who have any queries or tackle our Assistance team.

- Put an digital signature on your Form 5304-SIMPLE online Connecticut aided by the enable of Indicator Instrument.

- Once the form is completed, push Finished.

- Distribute the all set variety by means of e-mail or fax, print it out or help save on the product.

PDF editor allows you to make adjustments with your Form 5304-SIMPLE online Connecticut from any world-wide-web connected equipment, personalize it in line with your requirements, indication it electronically and distribute in several methods.