Award-winning PDF software

Form 5304-SIMPLE for Pompano Beach Florida: What You Should Know

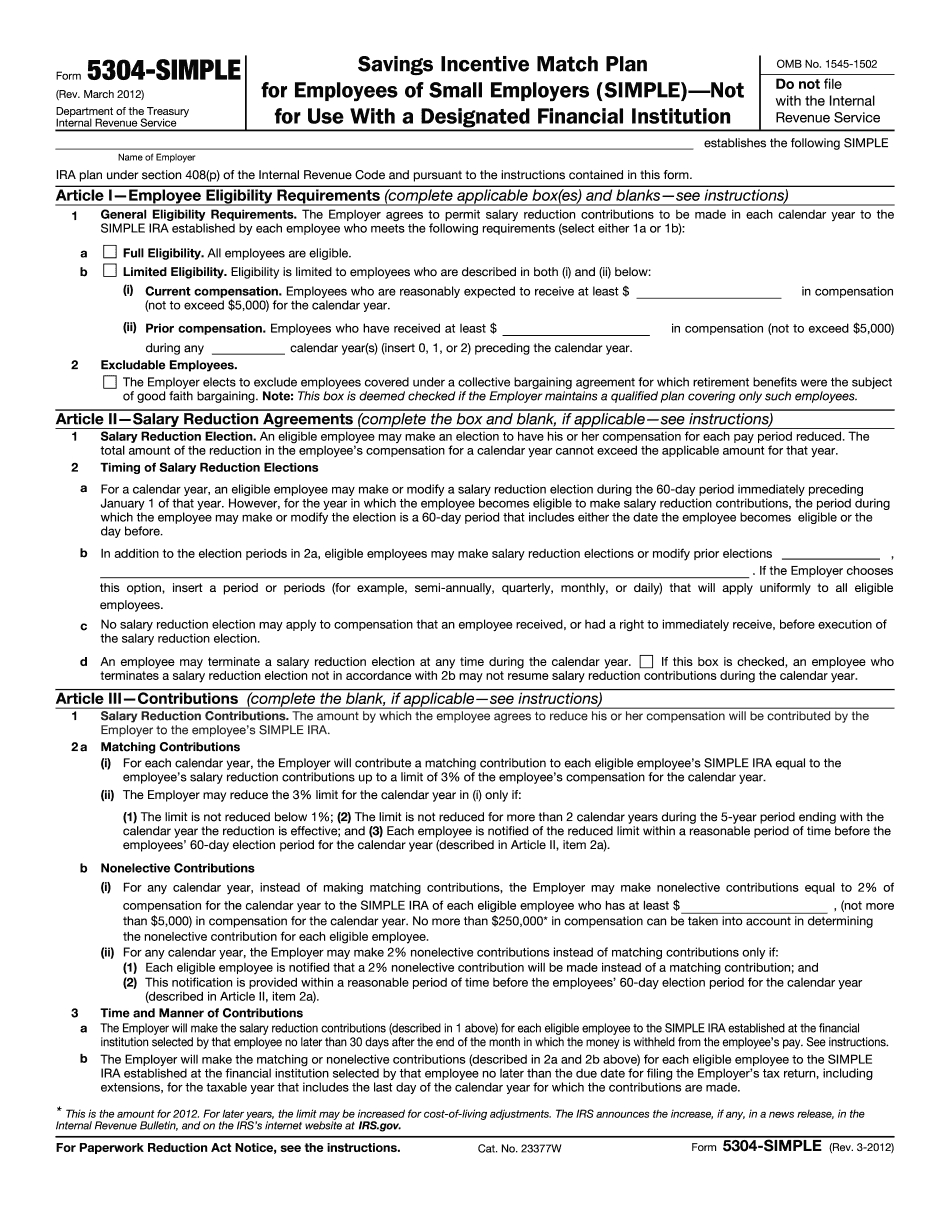

This is a template for your needs, just fill your form to get the required tax forms as a PDF! Form 5304-SIMPLE Tax Forms for SIMPLE IRA or SIMPLE 401(K) 401(K) plans are tax forms written by the IRS that the employer and employee can use to save for retirement. These tax forms are available without the IRS signature in most states for a fee. The tax forms for SIMPLE IRA plans have four pages and there is no fee to file these forms. One exception is Florida. The tax forms are free for filing. The payment is made through a check or money order. The federal contribution test is set at 5% of an employee's wages up to the amount of Roth IRA contribution. The contribution is first split into a pre-tax and post-tax portion. There is an extra 1400 tax deduction for the non-Roth Roth distribution. These forms contain a statement from the employer to the employee. If the IRA plan has to be carried forward to the employee, it has to be reported in the employee's next W-2 or other appropriate tax form. If this is required, the employer must file Form 5304-SIMPLE (Simple IRA Filing Agreement), which has the employee attest to the correct filing. FEDERAL REVENUE CODE (Sec. 59F) If the employee can contribute up to the Federal Tax Table limit and do not exceed the employee's earnings (at the start of the year or if the employer's wage base is at 100% that year), the tax will not be applied to the employer's contribution. The tax rules are more complicated for SIMPLE 401(K) accounts. A SIMPLE 401(K) account may be subject to the federal income withholding tax. In either case the SIMPLE IRA contribution rules are explained in IRS Form 5304-SIMPLE SIMPLE IRA contributions are not subject to the contribution limit and are tax-deductible if made before 59 years of age and the plan has already been converted to any other type of IRA. INVESTMENTS It's easy to build a pension plan for your business.

Online methods assist you to arrange your doc management and supercharge the productiveness within your workflow. Go along with the short guideline to be able to complete Form 5304-SIMPLE for Pompano Beach Florida, keep away from glitches and furnish it inside a timely method:

How to complete a Form 5304-SIMPLE for Pompano Beach Florida?

- On the web site along with the sort, click Commence Now and go to your editor.

- Use the clues to complete the suitable fields.

- Include your personal info and contact data.

- Make certainly that you simply enter right knowledge and numbers in ideal fields.

- Carefully verify the articles from the type in addition as grammar and spelling.

- Refer to aid portion for those who have any queries or tackle our Assistance team.

- Put an digital signature on your Form 5304-SIMPLE for Pompano Beach Florida aided by the enable of Indicator Instrument.

- Once the form is completed, push Finished.

- Distribute the all set variety by means of e-mail or fax, print it out or help save on the product.

PDF editor allows you to make adjustments with your Form 5304-SIMPLE for Pompano Beach Florida from any world-wide-web connected equipment, personalize it in line with your requirements, indication it electronically and distribute in several methods.